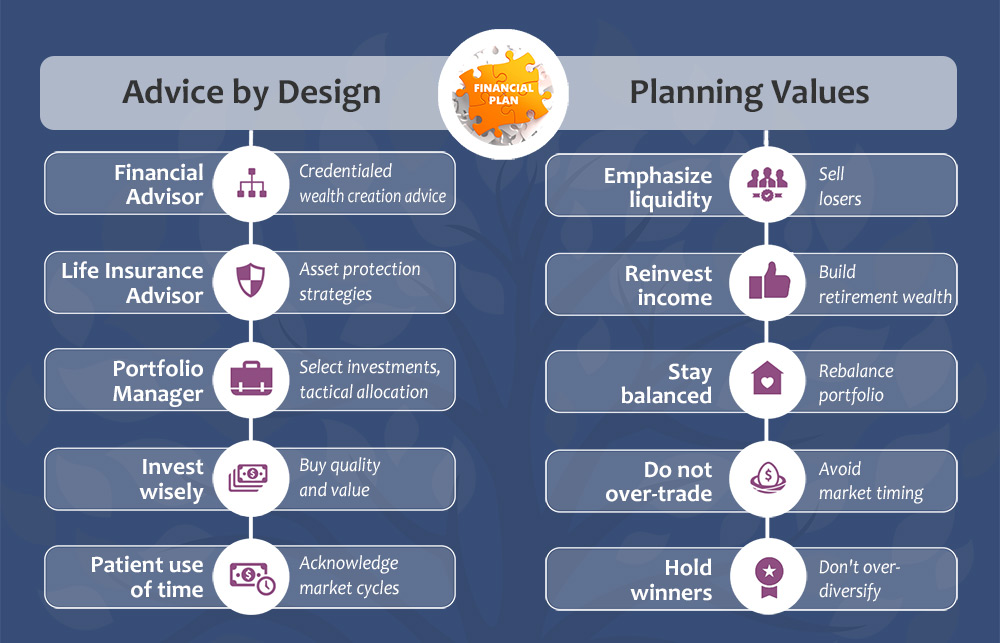

When planning your investments it is important to use an advisor who is trained to understand the following strategies with regard to the influence of business and market cycles. It is also important that your advisor has the know-how and has a strategy actively lined up similar to or a variation of the tactical solutions in the following table:

Long-term investors understand that markets are cyclic

You have probably heard the term “bull market” with reference to a rising market and “bear market” with regard to a falling market. These primary market trends are most obvious because they correlate to the business cycles of expansion and retraction.

Bullish trend The economy’s expanding boom and cycles of correction always recur, on average, every 4 to 7 years. The rising price of stocks during a bull market can occur over a period of three or more years. Bull markets generally precede and give impetus to an economy’s robust period of business growth which we have been witnessing over the last year.

Bearish trend The bear market’s period lasts on average just over a year. This is when share prices can go lower and may be followed typically by an economic downturn. Don’t confuse this with a correction when investors reallocate sectors and/or investments. A correction of 10% is normal over a long bull run.

The “buy and hold” investment fund investor understands that business cycles and related stock market trends are quite normal. Even during the booming bull phase, a fund’s unit price can drop slightly if there is a stock market correction. The fund’s unit price can also rise remarkably during a stock market rally which often occurs right after a period when the market has a correction and has not yet entered into a bearish cycle.

Questions to ask when planning to make an investment:

1. Can my money be tied up for periods of four or more years?

2. What are my retirement needs and how long do I have before I need to draw an income?

3. Is capital growth on investment a priority?

4. Do I want to receive dividends on my equity fund?

5. Do I have the patience to stay invested when the market drops?

6. How important is the security of my capital? Do I fear short-term loss?

7. Is the investment fund a proven performer over longer periods of time such as over five or ten years?

8. Does the fund hold equities issued by larger, successful companies with a value-oriented investment style? These, such as Canadian bank stocks, tend to perform well over longer protracted periods.

9. Does the fund hold equities issued by companies investing primarily for aggressive growth? These may experience more of a pullback in a correction.

10. Do I acknowledge that market fluctuations are normal?